Credit Diagnostics

If money has been feeling heavy lately and every

NYK is a numbers-first financing and debt advisory. We’re here for people who don’t want “sales talk” — they want a calm, independent view of what’s realistic before they sign anything.

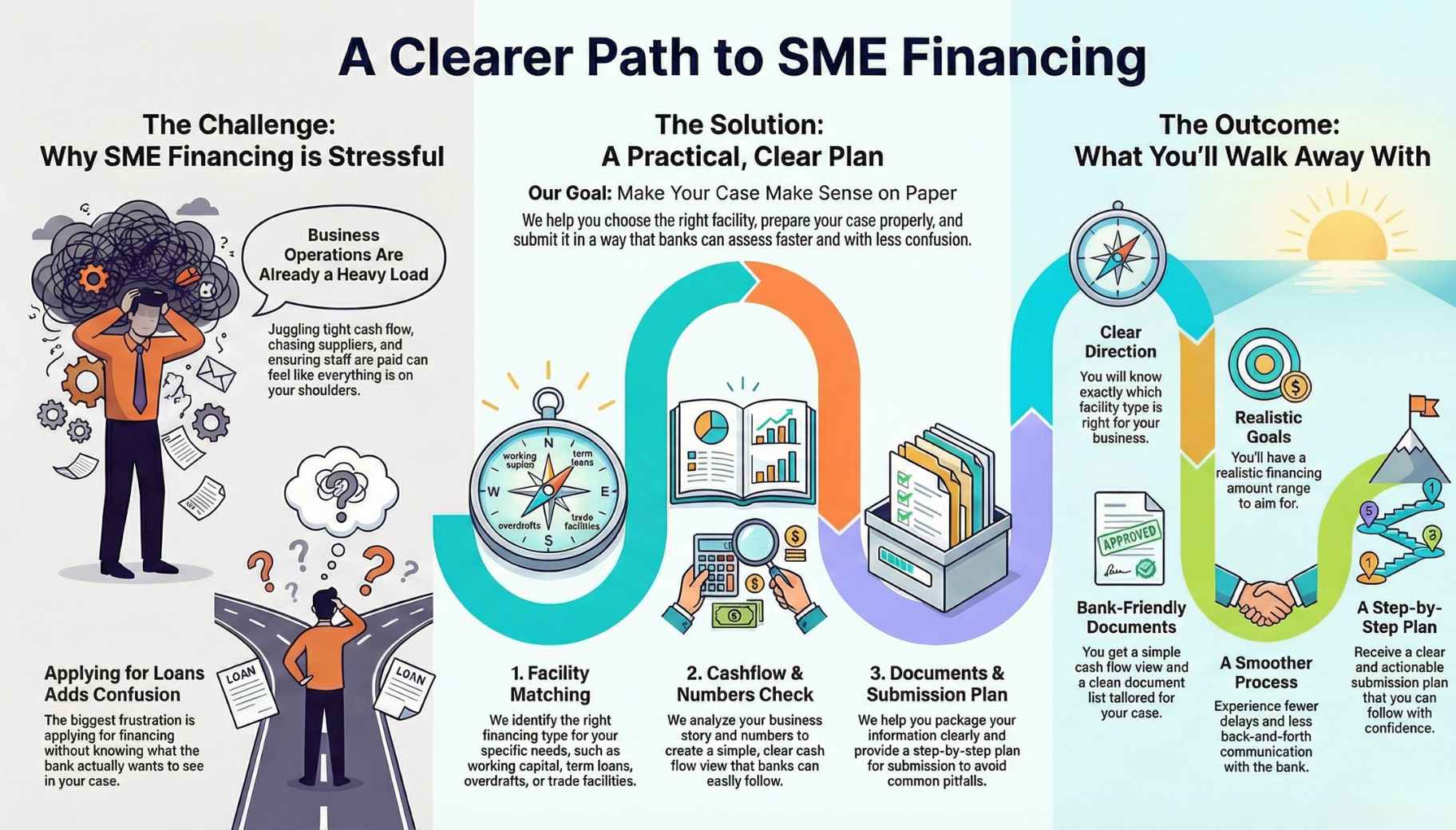

Running a business is already stressful. When cashflow gets tight, suppliers chase, and you still need to pay staff, it can feel like everything is on your shoulders. The worst part is applying for financing and not knowing what the bank actually wants.

SME Financing is where we help you choose the right facility, prepare your case properly, and submit in a way that makes sense on paper. No overpromising. Just a clear plan you can follow.

After this, you’ll walk away with:

We keep it practical. We look at your business story, your numbers, and your goal, then help you package it clearly so the bank can assess faster and with less confusion.

Working capital, term loan, overdraft, trade facilities, and refinancing. We’ll guide you to the one that fits your need, not just “take loan only”.

Basic business info, 6 months bank statements, and what you need the money for. If you have financial statements, management accounts, or tax docs, even better.

Yes, many SMEs are like that. We’ll tell you what is missing, what can be explained, and what must be prepared properly before you submit.

No. Approval is still the bank’s decision. What we do is make your case clearer and more complete, so you are not rejected for avoidable reasons.

Often yes, especially for SMEs. That’s why we also sanity-check the overall burden and make sure the story and numbers stay consistent.

If money has been feeling heavy lately and every

If your monthly payments are getting harder to keep

If you’re thinking about taking a new loan, refinancing,