Credit Diagnostics

If money has been feeling heavy lately and every

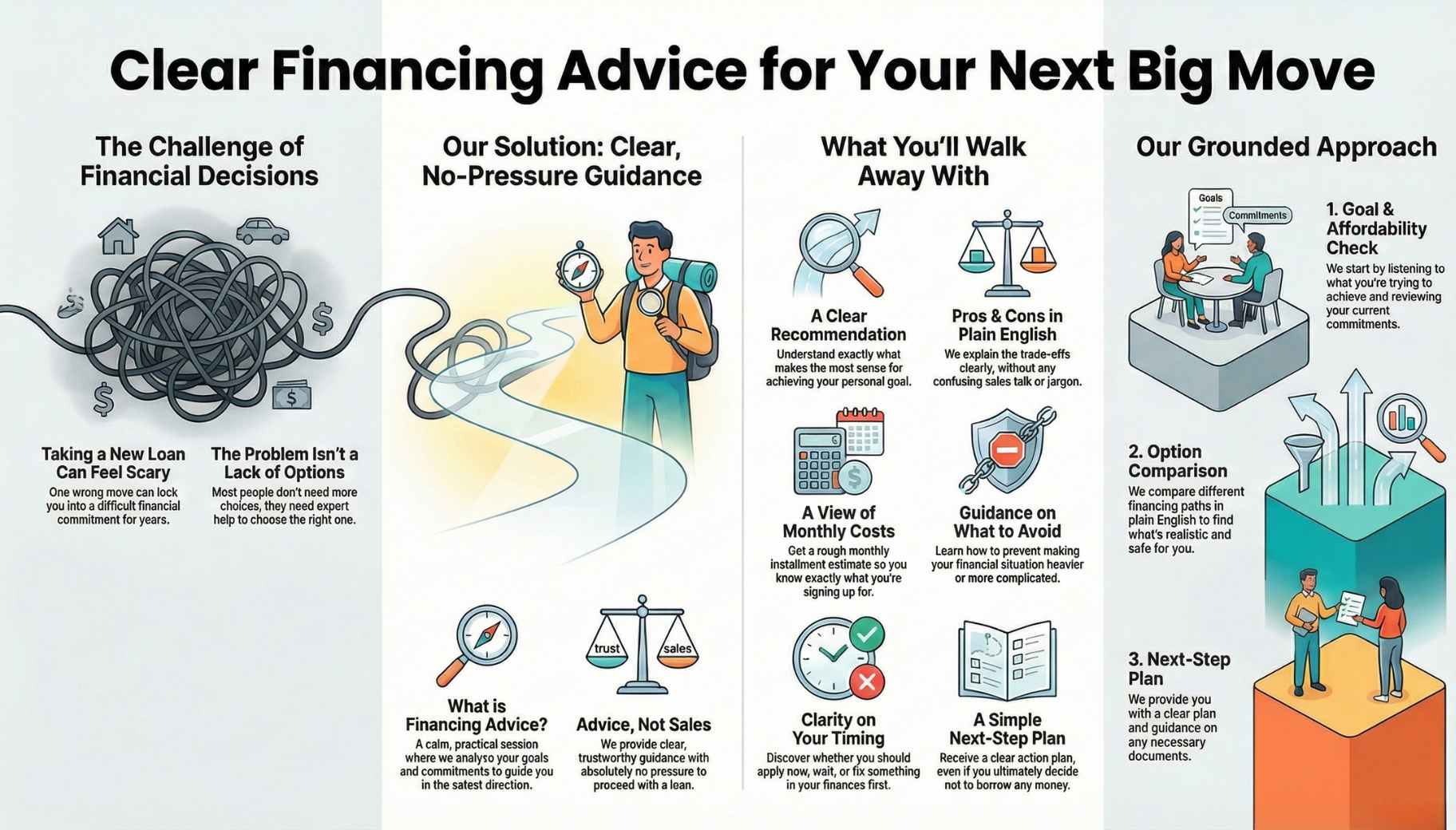

NYK is a numbers-first financing and debt advisory. We’re here for people who don’t want “sales talk” — they want a calm, independent view of what’s realistic before they sign anything.

If you’re thinking about taking a new loan, refinancing, or topping up, it can feel scary because one wrong move can lock you in for years. Most people don’t need “more options”. They need someone to help them choose the right one.

Financing Advice is a calm, practical session where we look at your goal and your current commitments, then guide you on the safest direction. No pressure to proceed. Just clear advice you can trust.

After this, you’ll walk away with:

We keep it grounded. We listen to what you’re trying to achieve, check your current commitments, then guide you towards a financing path that is realistic and safer for you.

No. This is advice, not pressure. If borrowing doesn’t make sense, we’ll tell you straight.

Not always. It depends on your current rate, tenure, fees, and whether the new structure actually lowers your monthly burden or just extends the pain.

Yes. We’ll break down monthly instalments, total repayment, and the trade-offs in a simple way.

That’s okay. We’ll tell you what to fix first and what timeline makes sense, so your next move is not rushed.

Basic income info, your existing loan details, and what you’re trying to achieve. If you have CCRIS, it helps, but we can start even without it.

If money has been feeling heavy lately and every

If your monthly payments are getting harder to keep

Sometimes the issue isn’t your income. It’s the paperwork.