Credit Diagnostics

If money has been feeling heavy lately and every

NYK is a numbers-first financing and debt advisory. We’re here for people who don’t want “sales talk” — they want a calm, independent view of what’s realistic before they sign anything.

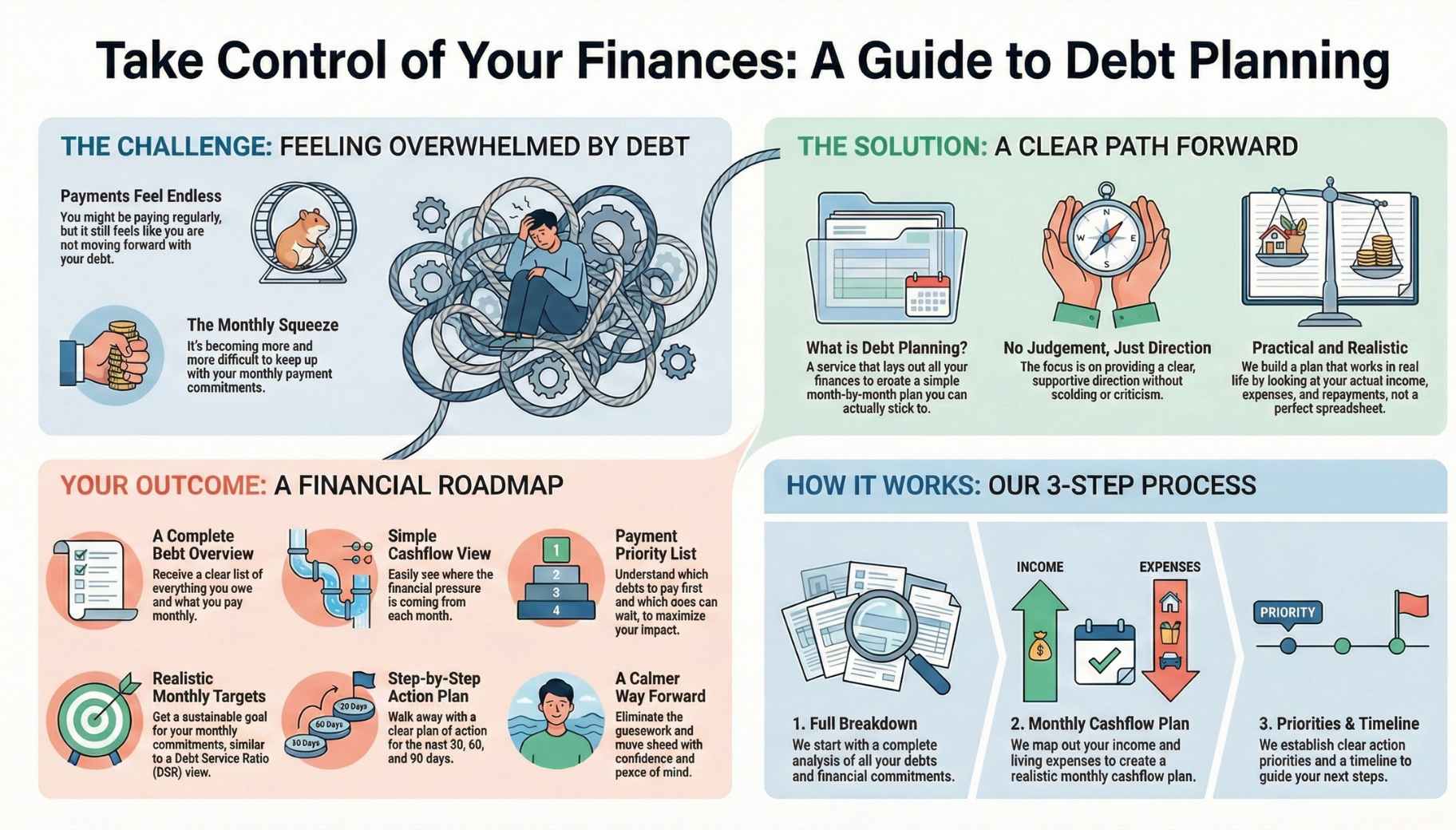

If your monthly payments are getting harder to keep up with, it’s exhausting. You might be paying and paying, but somehow it still feels like you are not moving forward.

Debt Planning is where we lay everything out properly, then turn it into a simple month-by-month plan you can actually stick to. No judgement, no scolding, just a clear direction.

After this, you’ll walk away with:

We keep it practical. We look at your income, living expenses, and all repayments, then we build a plan that works in real life, not a perfect spreadsheet.

No. Debt Planning is the starting point. It helps you see the full picture and decide the safest next move. Consolidation is only one possible option.

No. A plan that feels impossible won’t last. We focus on realistic adjustments you can maintain.

That’s exactly when planning matters most. We’ll help you prioritise what must be paid first, what can be reduced, and what needs a stronger solution.

Yes. Banks may offer repayment assistance such as rescheduling or restructuring depending on your situation. We can guide you on how to prepare and what to ask, so the conversation is clearer.

If you need structured support, AKPK has programmes like the Debt Management Programme that help borrowers work out a repayment plan and engage participating credit providers.

If money has been feeling heavy lately and every

If you’re thinking about taking a new loan, refinancing,

Sometimes the issue isn’t your income. It’s the paperwork.