Credit Diagnostics

If money has been feeling heavy lately and every

NYK is a numbers-first financing and debt advisory. We’re here for people who don’t want “sales talk” — they want a calm, independent view of what’s realistic before they sign anything.

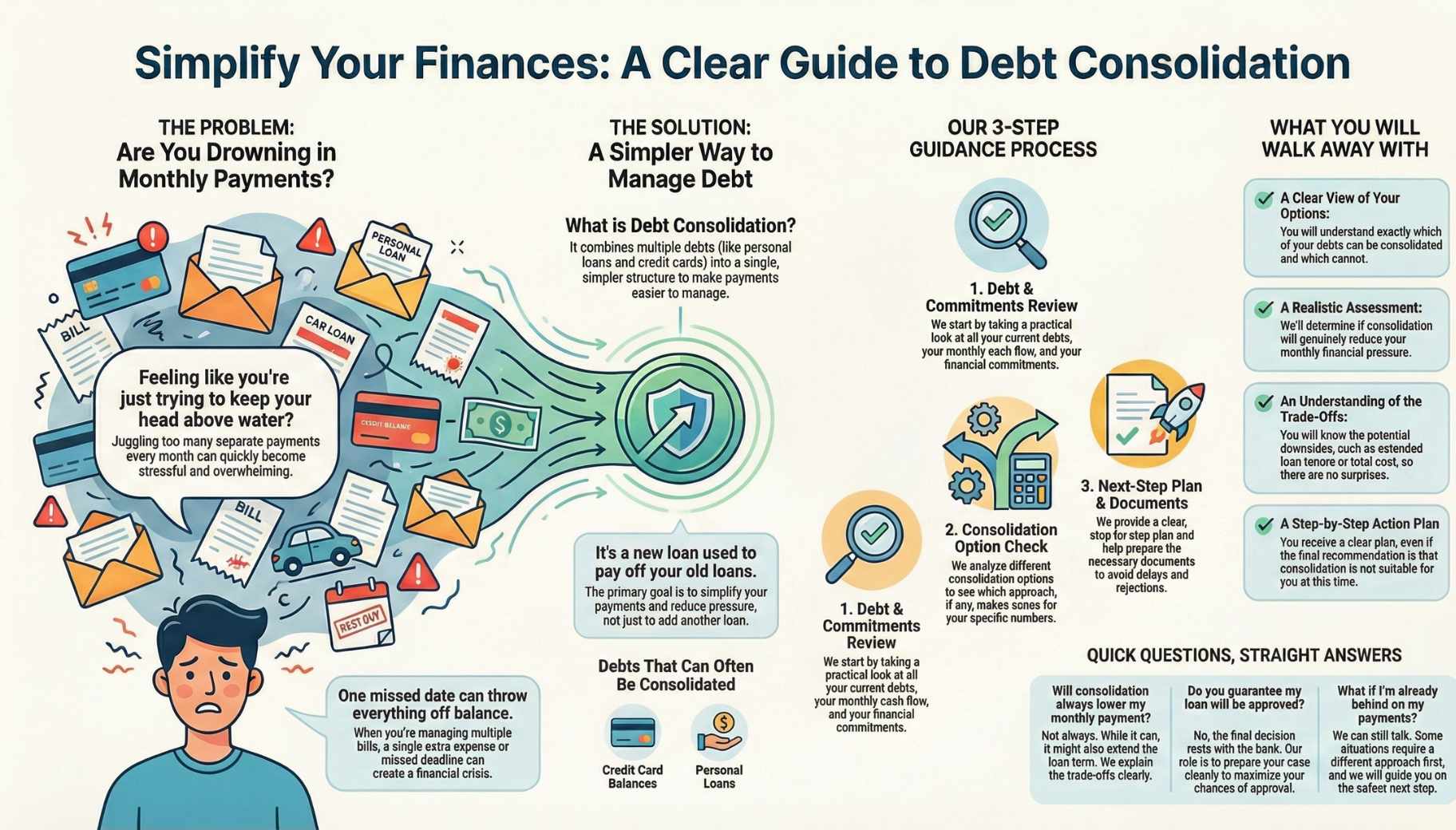

If you’re juggling too many payments every month, it can feel like you’re just trying to keep the water from overflowing. One missed date, one extra bill, and everything becomes stressful fast.

Debt Consolidation helps you combine multiple debts into a simpler structure, so it’s easier to manage and you can breathe a bit. We’ll guide you carefully, based on what actually makes sense for your numbers.

After this, you’ll walk away with:

We keep it practical and safe. We look at your debts, your monthly cashflow, and your current commitments, then guide you towards a consolidation approach that reduces stress, not adds new problems.

Often personal loans, credit card balances, and some other unsecured commitments. We’ll check your mix and tell you what’s realistic.

Not always. It can reduce the monthly amount, but sometimes it extends the tenure or increases total cost. We’ll explain the trade-off clearly.

In simple terms, yes. But the point is to make it easier to manage and reduce pressure. If it doesn’t truly help, we won’t recommend it.

No. Approval is still the bank’s decision. We focus on matching your case properly and preparing it cleanly to reduce avoidable rejection.

Still can talk. Some cases need a different approach first, like stabilising cashflow or restructuring. We’ll guide you on the safest next step.

If money has been feeling heavy lately and every

If your monthly payments are getting harder to keep

If you’re thinking about taking a new loan, refinancing,