Debt Planning

If your monthly payments are getting harder to keep

NYK is a numbers-first financing and debt advisory. We’re here for people who don’t want “sales talk” — they want a calm, independent view of what’s realistic before they sign anything.

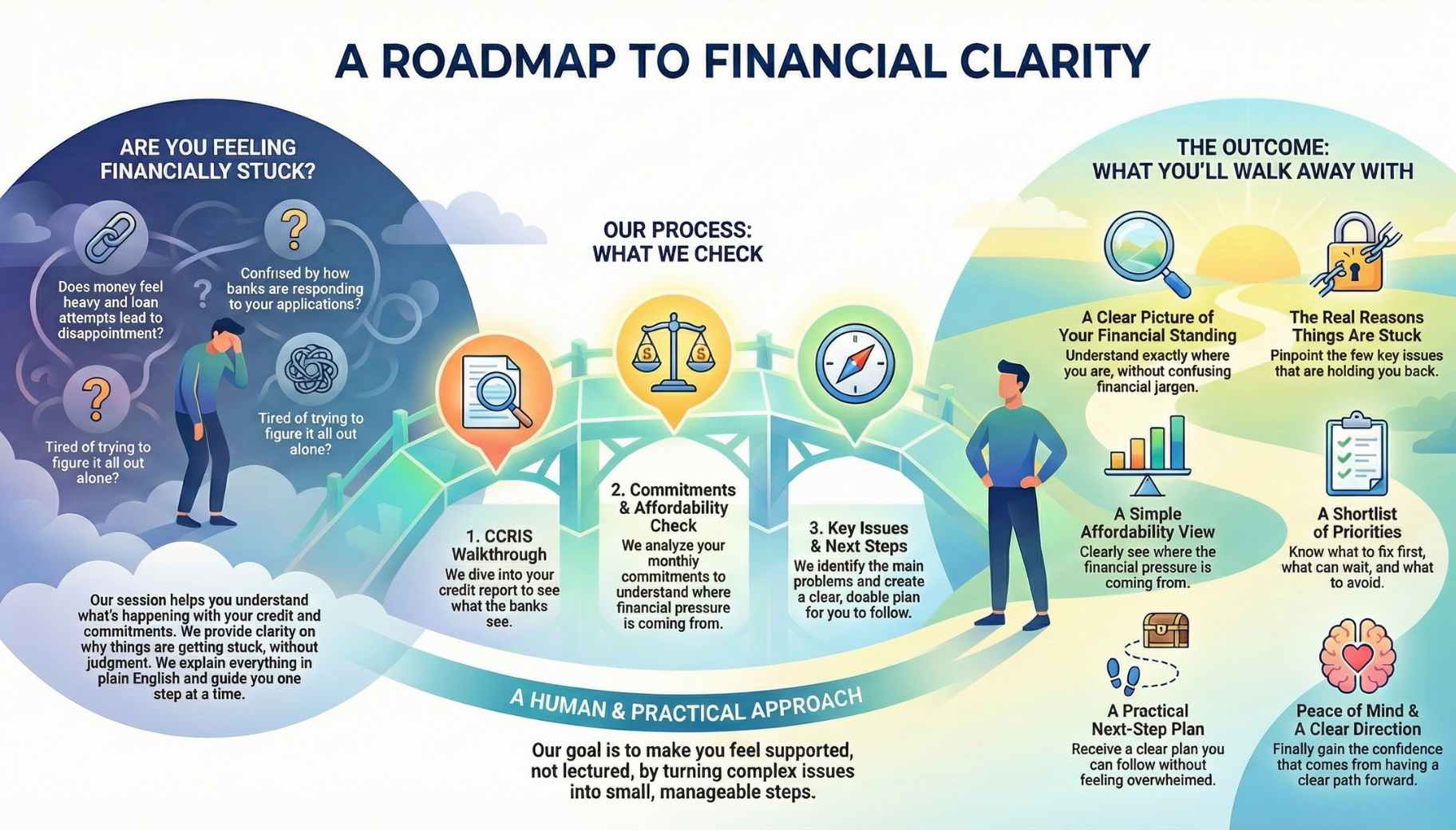

If money has been feeling heavy lately and every loan attempt feels like another disappointment, we get it.

This Credit Diagnostics session helps you understand what’s happening in your CCRIS and monthly commitments, and why the bank is responding the way it is. Not to judge you, just to give you clarity.

You don’t need to figure it out alone anymore. We’ll explain it in plain English, then guide you on the next step that makes sense for your situation, calmly and one step at a time.

After this, you’ll walk away with:

We keep it human and practical. We look at what banks usually focus on, explain what it means for you, and turn it into small, doable steps, so you feel supported, not lectured.

Yes. We’ll guide you step by step to download it from eCCRIS. For safety, we will never ask for your password or OTP. Only you should log in and download your report.

If you give us your consent, we can help run the CTOS check and review it together. Consent is required before a credit report can be disclosed or shared.

Just tell us which one you want first. For CCRIS, you download and send it to us. For CTOS, we will share a consent form for you to approve first, then we proceed.

Yes, as long as you share only the report file itself and keep your login details private. We will never ask for your password, OTP, or MFA codes. For CTOS, we only proceed with a check when you have given consent, and the use and disclosure of credit information is governed by the rules under the Credit Reporting Agencies framework.

No. We are just reviewing your reports and your numbers with you. What can leave a trail is repeatedly applying to multiple banks without a plan. That’s why we help you diagnose first, then move only when it makes sense.

If your monthly payments are getting harder to keep

If you’re thinking about taking a new loan, refinancing,

Sometimes the issue isn’t your income. It’s the paperwork.