Credit Diagnostics

If money has been feeling heavy lately and every

NYK is a numbers-first financing and debt advisory. We’re here for people who don’t want “sales talk” — they want a calm, independent view of what’s realistic before they sign anything.

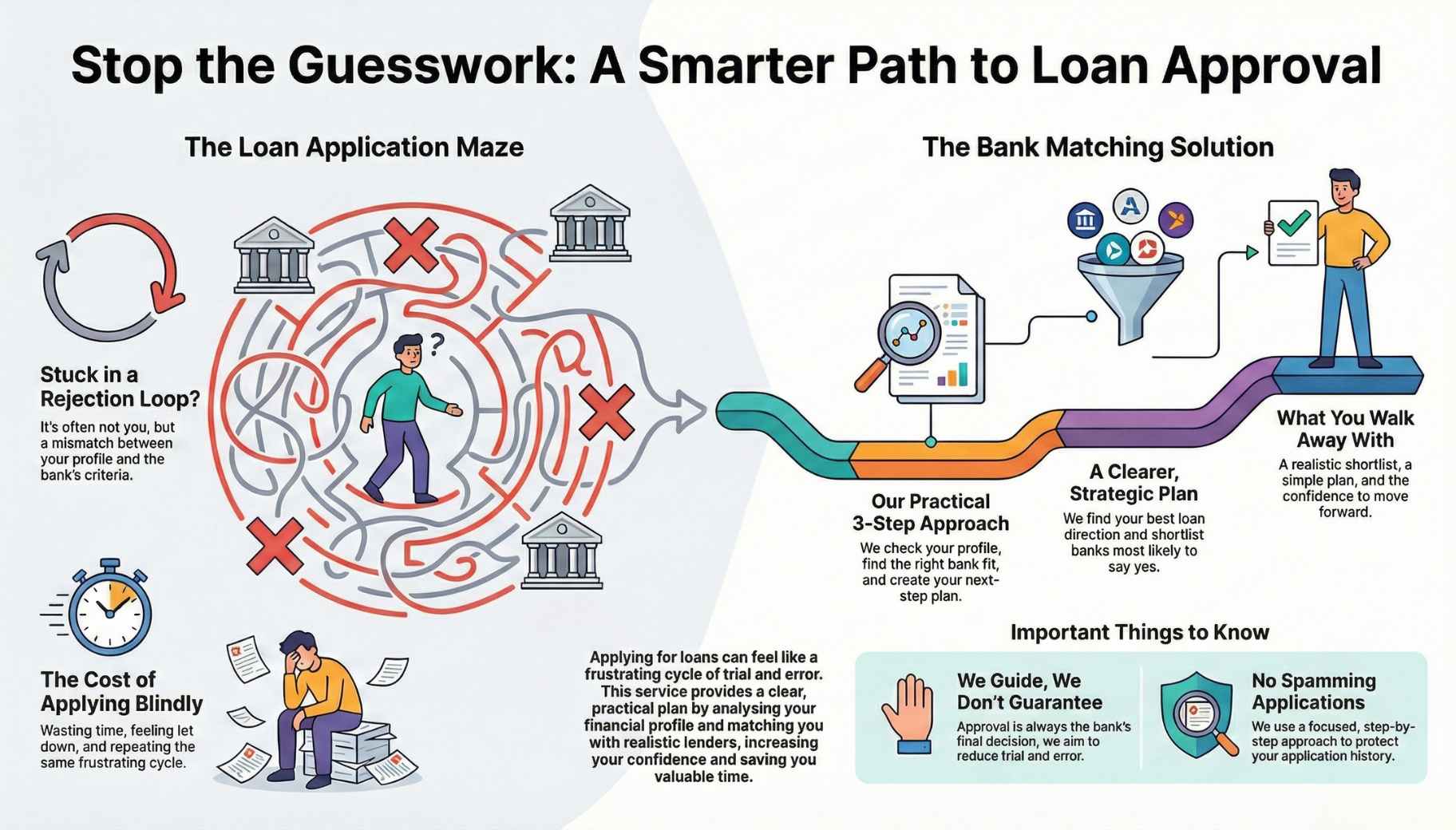

If you’re tired of applying and getting nowhere, it can start to feel like the problem is you. Most of the time, it’s not. It’s just the wrong bank, the wrong product, or the wrong way the case is presented.

Our Bank Matching service helps you pick the most realistic path based on your profile, so you stop wasting time, stop feeling let down, and move with a clearer plan.

After this, you’ll walk away with:

We keep it practical. We look at your numbers, your commitments, and what you’re trying to achieve. Then we guide you towards the options that are more likely to make sense for you.

We help you choose the most realistic loan direction and shortlist options that fit your profile, so you don’t waste time applying blindly.

Your income type, rough monthly commitments, the amount you’re aiming for, and your goal. If you already have CCRIS or CTOS, it helps, but it’s not a must to start.

No. Approval is still the bank’s decision. What we do is reduce trial and error by guiding you towards options that make sense for your situation.

No. We don’t spam applications. We prefer a step-by-step approach so you stay in control and don’t burn unnecessary attempts.

Yes, sometimes. It’s normal for banks to request further documents or clarifications as part of their verification process. We’ll tell you what to prepare so it’s smoother and less stressful.

If money has been feeling heavy lately and every

If your monthly payments are getting harder to keep

If you’re thinking about taking a new loan, refinancing,