A rejection feels personal. But most of the time, it’s not. It’s a simple “risk + affordability” decision based on what your file shows.

In NYK, we see this pattern a lot: people reapply immediately, collect more rejections, and make the profile look worse—when the fix was actually straightforward.

This post breaks down the real reasons Malaysian banks reject applications and gives you a clean plan to fix the right thing first.

Why do banks reject loan applications in Malaysia?

Banks reject loans when they’re not confident you can repay comfortably, or when your profile/documentation doesn’t meet their eligibility and affordability checks. Most rejections come from affordability (DSR/commitments), income stability, incomplete documents, or unfavourable repayment behaviour.

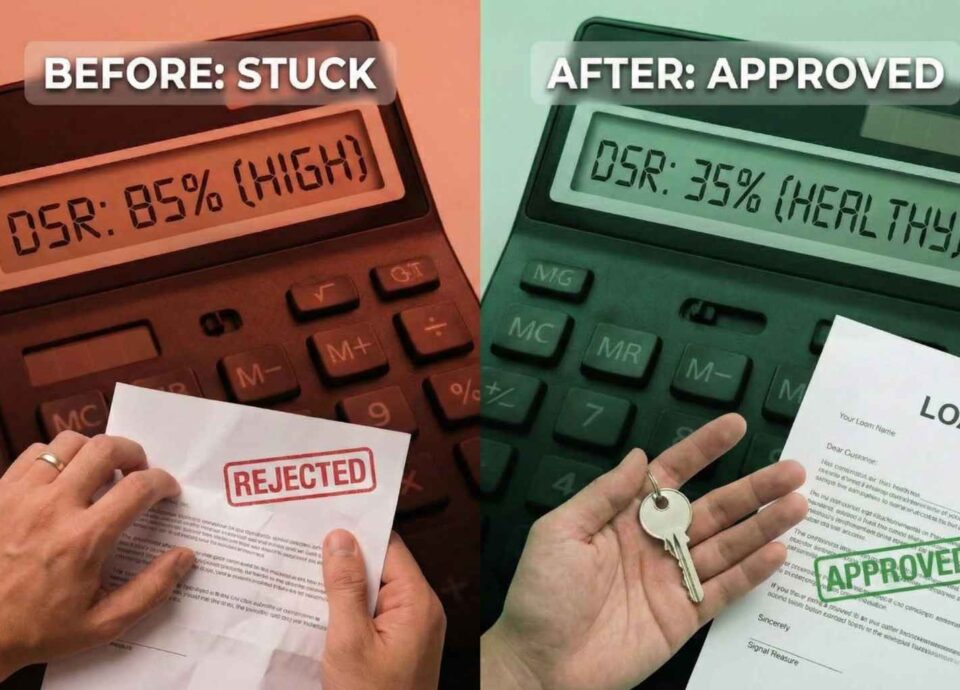

1) Is your DSR too tight?

DSR (Debt Service Ratio) is how much of your monthly net income goes to debt repayments. If the bank thinks your buffer is too thin after commitments, approval becomes difficult even if you “technically can pay”.

A commonly used formula is:

DSR = (Total monthly debt commitments ÷ Net monthly income) × 100

Banks may also count non-bank instalments (depending on policy and what is visible/declared), so your DSR can be higher than expected.

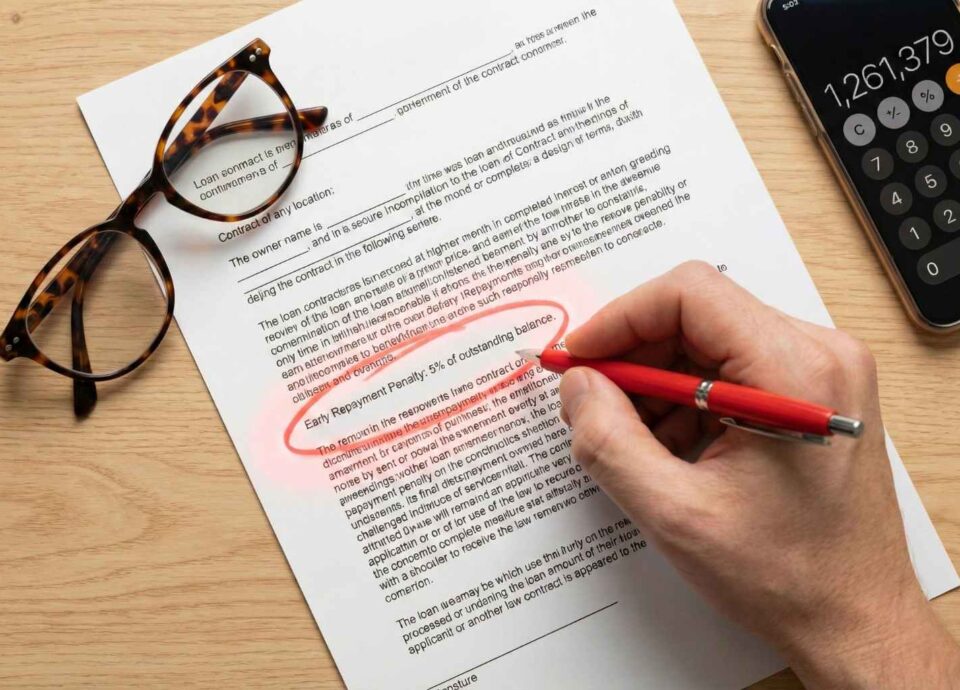

2) Are your documents incomplete or “don’t tell one story”?

A lot of files die quietly because documents are missing, cropped, outdated, or inconsistent. Even strong applicants get delayed when payslips don’t match bank credits, or when key pages (name/account number) are missing.

If you want the exact pack, use our checklist post:

3) Does your income/employment fail the bank’s basic eligibility rules?

Every bank/product has minimum eligibility rules (income level, age, employment stability). If you miss them, the system may reject you even before a human reviews the file.

Examples of published eligibility criteria banks may state include:

- Minimum monthly income thresholds

- Required employment stability (e.g., a minimum number of months employed)

- For self-employed: business must be active for a minimum period

4) Did the bank read your income as “unstable” (even if you earn more some months)?

Banks generally prefer stable, provable income. If your income is variable (commission/bonus/self-employed), the bank may average it or recognise only part of it unless your documents show a consistent pattern.

Common triggers:

- Income jumps wildly month to month with no explanation

- Cash deposits with no supporting proof

- Bank statement inflows don’t align with what you declare

5) Is your repayment behaviour raising questions?

Even when affordability is okay, repayment behaviour can kill confidence. Underwriters look for stability and patterns—especially in recent months.

What usually hurts:

- Repeated late-payment patterns

- A “stop-start” repayment trend

- Multiple facilities showing stress at the same time

6) Did you apply too many times in a short window?

Multiple applications within a short period can create friction because it looks like “credit shopping”. It can also trigger tougher questions: “Why so many applications? What’s the urgency? What changed?”

This doesn’t mean you can’t apply again. It means: don’t do it blindly.

7) Are you applying for the wrong product/bank for your profile?

Sometimes your profile isn’t “bad”—it’s just mismatched. Different banks and products assess variable income, self-employed cashflow, and commitments differently.

We often see:

- Self-employed applying like salaried (wrong docs, wrong structure)

- Commission earners using only payslips (no pattern proof)

- Applicants trying the “easiest” bank first instead of the right one

What to do next after a rejection

Don’t reapply immediately. Fix the cause first. Here’s the clean plan:

Step 1: Identify which bucket you’re in

- Affordability issue (DSR/commitments)

- Documentation issue

- Eligibility issue (income/employment rules)

- Repayment behaviour issue

- Application strategy issue (too many checks / wrong bank)

Step 2: Apply the fastest lever

- If DSR is tight → reduce real monthly commitments or improve provable income

- If docs are messy → rebuild a clean, complete PDF pack

- If eligibility is the issue → stop wasting applications; target the right product/bank

- If repayment behaviour is the issue → stabilise first, then apply once

- If strategy is the issue → pause, then apply with a plan

Step 3: Reapply once, properly

One good application beats five emotional ones.

A quick “pre-submit” checklist (copy-paste)

Before you apply again, check these:

- I know my DSR using net income (not gross)

- My documents are complete (not cropped) and consistent

- Payslip income matches bank statement salary credits (if salaried)

- Self-employed cashflow has a clear explanation + supporting proof

- I’m applying to the right bank/product for my income type

- I’m not mass-applying within a short window

Conclusion

A rejection usually means one thing: the bank couldn’t see a comfortable repayment story.

Your job isn’t to “try more banks”. Your job is to fix the one thing the file is failing—then apply once with a clean strategy. That’s how approvals become predictable instead of lucky 🙂